Key takeaways

- Operational risk encompasses internal and external threats. This includes human error, process failures, system breakdowns, and natural disasters, which can disrupt a business and result in financial or reputational harm.

- Proactive operational risk management (ORM) helps businesses maintain stability, reduce the cost of disruptions, and respond swiftly to challenges.

- Common causes of operational risk range from data entry errors and system crashes to supply chain delays and cyberattacks, all of which can lead to major operational and financial setbacks.

- ORM involves five key steps: identifying risks, assessing likelihood and impact, mitigating through controls, continuously monitoring for new risks, and reporting to stakeholders for transparency.

- Tools like inventory and manufacturing software minimize operational risk by automating tasks, reducing human error, and enabling real-time tracking.

Operational risk is a critical concept in business. It refers to the uncertainties and potential hazards that arise from everyday activities, including process failures, human errors, system breakdowns, or external events. It encompasses a wide range of uncertainties that can impact a company’s ability to operate efficiently and meet its objectives. Identifying and preparing for these risks is essential for businesses of all sizes. It helps safeguard against unexpected disruptions that can lead to financial loss, reputational damage, or regulatory penalties.

By proactively managing operational risks, companies can enhance their resilience, maintain stability, and ensure smooth ongoing operations. Being prepared also enables businesses to respond promptly to challenges, minimizing adverse effects and maintaining the trust of customers, stakeholders, and employees.

Common causes of operational risk

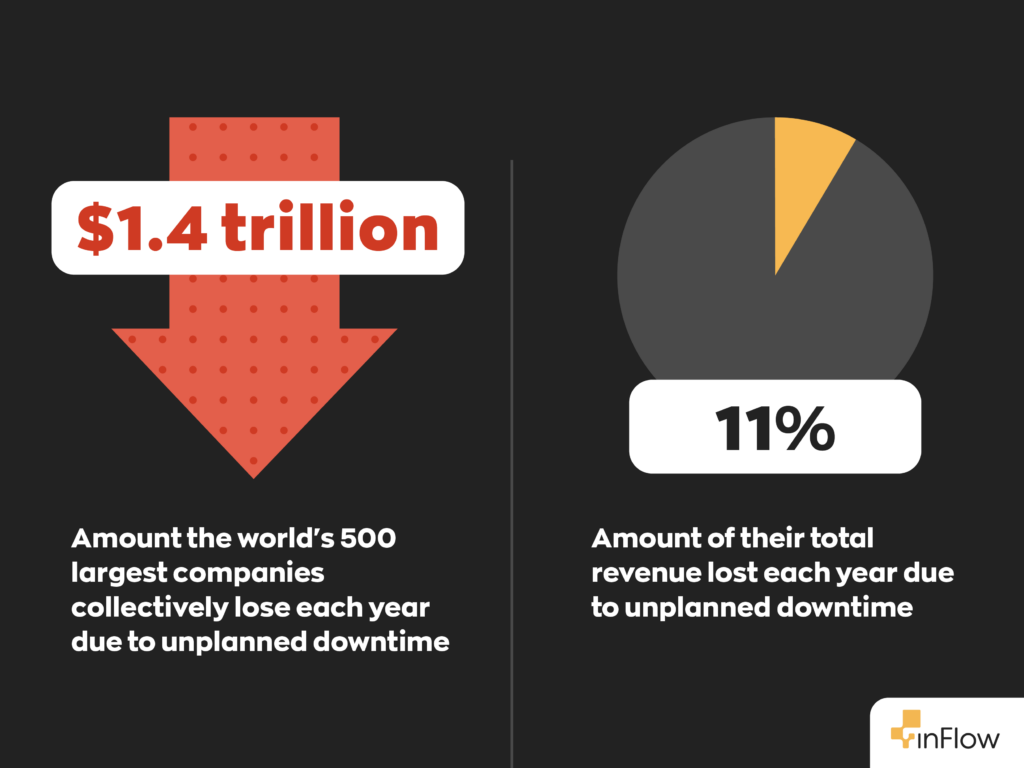

Operational risk can manifest in several forms, significantly impacting business operations. Human error, such as a data entry mistake, can lead to substantial financial reporting errors, as seen in high-profile finance sector mishaps. System failures, such as server crashes, can disrupt operations and customer access. The resulting downtime can be devastating, costing an estimated $1.4 trillion a year among the world’s 500 largest companies. Process breakdowns, like inefficiencies in supply chain management, can also wreak havoc, causing delayed deliveries that often result in stock shortages during peak retail periods.

Operational risks can also stem from external events like natural disasters or cyberattacks, which have led to hurricane-induced factory shutdowns and data breaches. These examples highlight why businesses must adopt robust risk management strategies to mitigate and respond effectively to such operational challenges. By anticipating potential disruptions, organizations can reinforce their resilience and ensure smoother operations despite unforeseen events.

What is operational risk management?

Operational risk management (ORM) is the systematic approach to identifying, assessing, mitigating, monitoring, and reporting risks that could disrupt everyday activities or lead to business asset losses. The main goal of ORM is to reduce the impact of unplanned events, helping a business to continue with as little cost as possible.

The ORM process begins with identification, where potential risks are identified across various facets of operations. These risks are then examined to evaluate their likelihood and potential impact. Mitigation then focuses on developing strategies to reduce the probability or consequences of risks, like implementing stronger controls or backup systems.

Ongoing efforts are needed to monitor potential risk factors and evaluate the effectiveness of mitigation strategies, especially as risks evolve over time. Finally, reporting ensures that stakeholders are informed about risk levels and management efforts, fostering transparency and accountability. Establishing a structured approach helps businesses respond more effectively, maintaining trust and stability amidst uncertainties.

Tools that help reduce operational risk

Inventory and manufacturing management software reduces operational risk by improving accuracy and efficiency. Automation and system integration minimize manual processes, thus preventing data entry errors that can lead to costly mistakes. The software helps automate routine tasks, such as updating stock levels or creating reports, which in turn helps businesses reduce the likelihood of human error and save valuable time.

Implementing strategies like barcoding and inventory tracking ensures precise, real-time data collection. This accuracy helps avoid discrepancies in inventory levels and supports better decision-making. For example, barcoding speeds up the inventory management process, ensuring accurate tracking of product movement and reducing the risk of misplaced items. Tracking inventory in real time allows companies to make adjustments as needed, reducing the time it takes to respond to issues like shortages. Collectively, these practices streamline operations, enhance data accuracy, and safeguard businesses against potential disruptions.

How to create an operational risk management plan

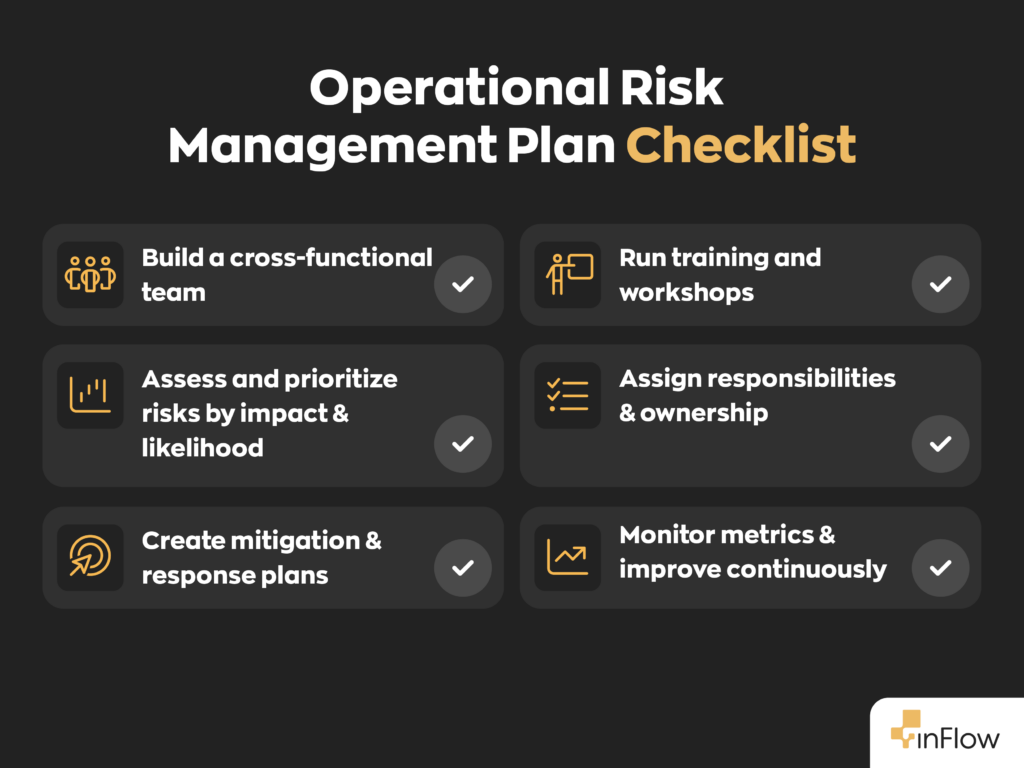

To create an effective ORM plan, start by assembling a cross-functional team from across the organization to provide a variety of perspectives. Begin with a risk assessment using tools or scorecards to prioritize risks based on potential impact and likelihood. Encourage open discussions to identify specific risks unique to each department while fostering a culture of transparency.

Next, develop tailored mitigation strategies for prioritized risks, ensuring they align with department-specific needs. Implement controls to minimize risks, clearly assigning responsibilities to relevant team members. Establish a plan for responding to risks, and regularly update it as needed to maintain its effectiveness.

Utilize continued training and workshops to encourage involvement and understanding from members throughout the organization. This process allows departments to manage risks proactively, safeguarding the organization’s assets and operations effectively.

Measuring and monitoring operational risk

To effectively monitor operational risk over time, businesses can track key metrics and indicators such as incident frequency, near-miss occurrences, processing error rates, and downtime. Monitoring these metrics provides insights into potential vulnerabilities and allows for timely interventions. When you incorporate feedback loops, such as employee and customer feedback, it supports continuous learning and adaptation.

Scenario planning is foundational for preparing organizations to respond to unforeseen events. It provides a structured approach to testing the robustness of current risk mitigation strategies and uncovering weaknesses in operations. By incorporating these elements, businesses can track operational risk effectively while fostering a culture of continuous improvement. This enables them to adapt to changing conditions and maintain resilience against potential disruptions.

0 Comments